+91-9958 726825

THE BANKRUPTCY TREND OF INDIAN COMPANIES: UNDERSTANDING THE SIGNIFICANCE OF RISK ASSESSMENT MODELS

|

The purpose of this paper is to advance and evaluate bankruptcy prediction models utilising multiple discriminant examination, regression investigation, and neural networks analysis for Indian enumerated firms. As a result, financial ratios are used to create bankruptcy prediction models three years before filing for bankruptcy. The sample spans 2013 to 2018 and includes 72 bankrupt and 72 non-bankrupt enterprises. The findings show that neural networks had the most significant arrangement accurateness for the 3 years leading up to the bankruptcy compared to multiple discriminant examination and regression analysis. The banking institutions, creditors, investors, and examiners may use this research to identify businesses most likely to case for bankruptcy.

|

|

The bankruptcy is defined as a situation "when an organisation is unable to honor its financial obligations or make payment to its creditors, it files for bankruptcy. A petition is filed in the court for the same where all the outstanding debts of the company are measured and paid out if not in full from the company's assets". Some of the Indian companies who became bankrupt includes Dewan Housing Finance Ltd, Bhushan Power and Steel, Essar Steel, Lanco Infra, Reliance Communications, Alok Industries, and Jet Airways etc. due to improper financial management in business. Once a corporation cannot pay back their debts or commitments, the bankruptcy process is started. It provides a new beginning for those struggling to make ends meet. The petition is filed to withdraw the bankruptcy procedure, whether on account of the debtor, which happens more commonly or in favour of financiers, which happens fewer times. All of the assets belonging to the debtor have been identified, and they could potentially be used to settle the obligation in whole or in part. An organisation files for bankruptcy when it cannot repay its creditors or respect its financial commitments. The probability that a corporation will not be able to complete all its obligations is recognised as the foreclosure risk, often referred to as the bankruptcy risk[16]. It is the probability that a business will not be ready to fulfil its obligations and pay off its financial debts, resulting in bankruptcy. Several investors consider the business's risk of insolvency before deciding whether to invest in securities or stocks. A drop in revenues and expenditures, unproductive divisions and production, and other warning signs of bankruptcy risk should prompt management to exercise caution. Calculating bankruptcy risks in good time might help you avoid dire scenarios when liquidating your business and paying off your obligations is the only option. At the same time, risk administration naturally emphasises risks and hazards, sometimes contradicting the company concept.

In research on financial and strategic management, forecasting bankruptcy is one of the areas that has received the most significant attention[24]. Early studies concentrated on the financial ratios between bankrupt and non-bankrupt organisations were compared, and the results presented that the percentages of bankrupt corporations were lower[27]. The multiple discriminant analysis was employed by Altman in 1968 to forecast business insolvency. Multiple discriminant analysis was the go-to technique for predicting company insolvency in the 1970s[1]. The logistic regression approach was promoted in the 1980s[30]. For the first time, Ohlson used logistic regression analysis to forecast bankruptcy[20]. Since neural networks have shown promise in bankruptcy prediction, several academics have started using them to make bankruptcy predictions in recent years, and neural networks were first utilised to predict the level of bankruptcy[9].

A financial risk is a form of risk that arises from an event and has an adverse impact on a company’s financial condition. Financial risk is a condition that arises as a result of changes, both internally and externally, that can be financially detrimental to a company. In general, financial risk is divided into two, namely systematic financial risk and non-systematic financial risk. The Systematic Risk is a financial risk that cannot be predicted or avoided due to several factors. For example, a pandemic, political climate, and so on that result in inflation, increased interest rates, and increased market volatility. While, Non-systematic risk Is a financial risk that befalls a organization due to an event. For example, loss or fraud. Generally, businesses also face Credit risk, liquidity risk, asset-backed risk, foreign investment risk, equity risk, and currency risk are all common forms of financial risk. Investors can use a number of financial risk ratios to assess a company's prospects.

This paper aims to develop bankruptcy prediction models utilising data from Indian listed firms and evaluate the effectiveness of the three frameworks adopting multiple discriminant analysis, logistics regression examination, and neural networks analysis. It is acknowledged that the study's results will aid in making wise financial and managerial decisions for managers, investors, bankers, auditors, lenders, and other people working in the finance industry.

|

|

The research methodology is deliberated in sections of research datasets, assortment of variables, discriminant analysis, regression analysis, and neural analysis as below.

Research Datasets The prediction of bankruptcy has been the subject of much investigation. Most of this research has used a formal definition of bankruptcy. India has no single, all-encompassing, and integrated corporate bankruptcy policy. The regulations pertaining to bankruptcy are enclosed by the Companies Act of 1956 and the Sick Industrial Companies Act of 1985. In consideration, an insolvent business that meets the requirements for a sick business under the Sick Industrial Companies Act of 1985 had its stock delisted. This statute defines an ill company as one whose net worth has fallen or whose overall losses have surpassed its net value. Due to this, the insolvent enterprises in the study had lower net valuations both currently and the year before being delisted from the National Stock Exchange[23]. The year of bankruptcy will be noted for insolvent enterprises when their net worth decreases. The economy of India saw considerable structural changes due to the start of economic liberalisation in 1991[22]. Consequently, the study's period runs from 2013 to 2018. A sample of 72 insolvent enterprises was created during this period using the description of bankruptcy described above. We chose a comparable company that didn't go bankrupt that was nearly matched for the amount of assets before the year of bankruptcy using Altman's (1968) method. Most prior studies on bankruptcy prediction have also employed this technique. The main goal of grouping firms to build bankruptcy models is to find essential distinctions between otherwise equivalent enterprises. The sample was comprised of a total of 144 businesses. The distinct analysis and holding samples are created by randomly dividing the insolvent and non-bankrupt enterprises. In the study, a total of 50 insolvent and 50 non-insolvent enterprises comprises the analysis sample, while 22 insolvent and 22 insolvent companies comprise the holdout sample. The present research uses financial ratios to create bankruptcy prediction models, much as other studies that used financial accounting ratios in their empirical investigations of bankruptcy prediction. Numerous important indicators of bankruptcy have been identified via prior research, and these predictors may be utilised to build bankruptcy prediction models for Indian enterprises.

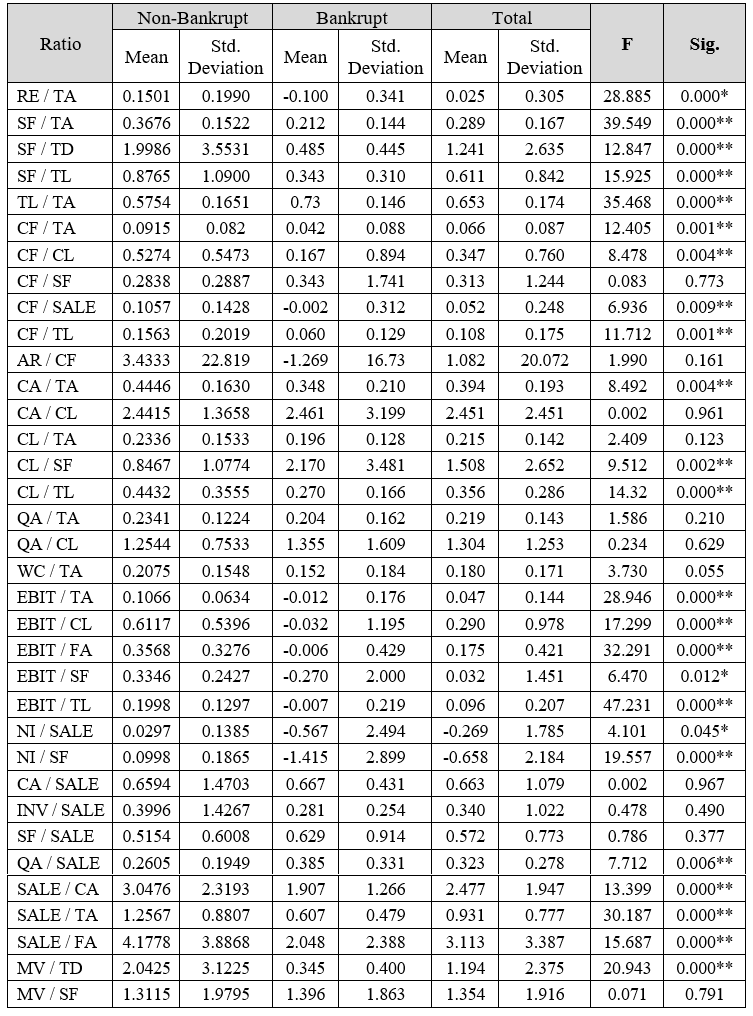

Assortment of Variables The present research uses financial ratios to create bankruptcy prediction models, much as other research that conducted empirical analyses of bankruptcy prediction using financial reporting ratios. Numerous important bankruptcy indicators have been identified via prior research, and these predictors may be utilised to build bankruptcy prediction models for Indian enterprises. Therefore, 35 financial ratios that have been effective in earlier research are used in this investigation. This research makes use of financial information from the Centre for Monitoring Indian Economy's Prowess database. The financial ratios of the firm for year one, year two, and year three previous to the year of bankruptcy made up the data sample. Data from non-bankrupt companies for the same year has been taken into account in the same way as it is for the corresponding bankrupt firm.

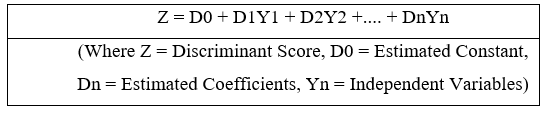

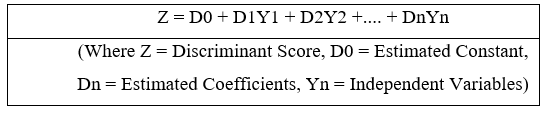

Discriminant Analysis Figure 1 : Discriminant Score Analysis

Regression Analysis

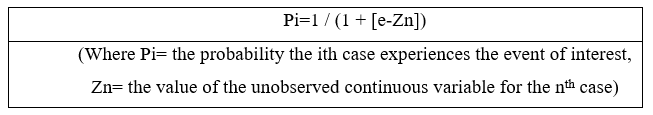

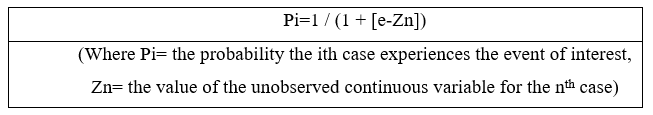

A specialised logistic regression is designed to forecast and clarify discrete categorical variables rather than measurements that rely on metrics. The likelihood that a complete factor dependence will occur is predicted using logistics regression using the constants of the independent variables. The method uses financial ratios to calculate a score for each firm to determine whether it will go bankrupt when used for bankruptcy prediction. The logistical function, which is used in the logistic regression method, may be expressed below.

Neural Analysis

The neurobiological processes serve as an inspiration for neural networks. A neural network is a computation scheme enclosed of multiple fundamental, intricately unified dispensation units that interpret data through their shifting states in response to external inputs, explains Robert Hecht-Nielsen, the originator of the first neurocomputers[7]. Numerous predicted algorithms for data mining employ neural networks due to their strength, adaptability, and simplicity. In situations where the fundamental structure is complicated, such as projecting customer demand to expedite manufacturing or rating a claimant to assess the menace of giving financing to the claimant, predicting neural networks is helpful. The neural networks may be an intriguing way to handle the classification problem when the distinction between achievement and failure is tolerable since they are functions of predictions known as intakes or autonomous variables that lower the prediction error of the goal variables called outcomes[6]. In a neural network, there are layers with many neurons connected to the layers between them through synapses. The neural network architecture comprises the data layer, which houses the predictors, and the hidden layer, which contains distant nodes or components. Each concealed unit's score expresses the predictors and the output level's responses. A bankruptcy record is encoded as two indicators as it is a category variable with two distinct groups. |

|

Several academics have analysed the effectiveness of various approaches to bankruptcy prediction. However, there has not been much study utilising the information from Indian businesses. Using data from seventy-four firms founded on Altman's five financial measures[1], Moreover, the contribution of Odom and Sharda examined the effectiveness of neural networks and discriminant analysis. They discovered that the neural network model outpaced discriminant analysis regarding outcomes[19]. With the neural network technique, 18.50% of the bankrupt enterprises were incorrectly categorised as non-bankrupt, compared to 40.70% with the discriminant investigation. Furthermore, Salchenberger, Cinar, and Lash examined the use of logistic regression with neural networks as the model in this setting[26]. When comparing classification accuracy, it was found that neural networks outperformed logistic regression by a wide margin.

The effectiveness of multiple discriminant analysis and neural networks was compared by Coats and Fant in 1993[10]. The classification performance of multiple discriminant analysis was 88.10%, whereas that of neural networks was 95.0%. Additionally, Kerling and Poddig in 1994 linked neural networks with discriminant research using a record of French enterprises[15]. The discriminant study provided 85.7% accuracy, whereas neural networks provided 86.50% accuracy. Additionally, using a sample of manufacturing companies, Zhang, Hu, Patuwo, and Indro in 1999 contrasted logistic regression with neural networks. They fed the neural network with the current assets or liabilities ratio and Altman's five financial ratios. Considering a precision of 87.2% vs 77.6%, the neural network significantly beat logistic regression[32]. On the basis of outcomes of logistic regression and neural networks, Charitou, Neophytou, and Charalambous in 2004 created models of bankruptcy prediction for UK engineering enterprises. According to the findings, the logistic regression model's classification rate was 74% on average[8]. On the other hand, the neural network model had the most effective overall categorisation rates, with an average classification rate of 76% for the three years preceding the bankruptcy. A study by Virag and Kristof in 2005 conducted a relative analysis of bankruptcy prediction models using the historical data of Hungarian corporations. They observed that neural network-based bankruptcy frameworks outperformed models based on multiple discriminant examinations and logistics regression analysis regarding classification accuracy[30]. The findings of specific investigations, however, were controversial. The neural networks and multiple discriminant analysis were used in a massive dataset of 1000 Italian companies during the year before bankruptcy by Altman, Marco, and Varetto in 1994. The contrast failed to provide a clear winner[2]. Moreover, Employing the indicators selected by Altman in 1968 and Ohlson, Boritz and Kennedy in 1995 examined a variety of methodologies, such as various neural network exercise methods, multivariate discriminant analysis and logistic regressions. The consequences of the assessment are equally ambiguous[4][1]. Therefore, founded on worldwide knowledge, comparative research is required to determine if global trends also influence Indian bankruptcy models for forecasting. |

|

The analysis and findings are presented in descriptive research, discriminant analysis, logistic regression and neural network sections.

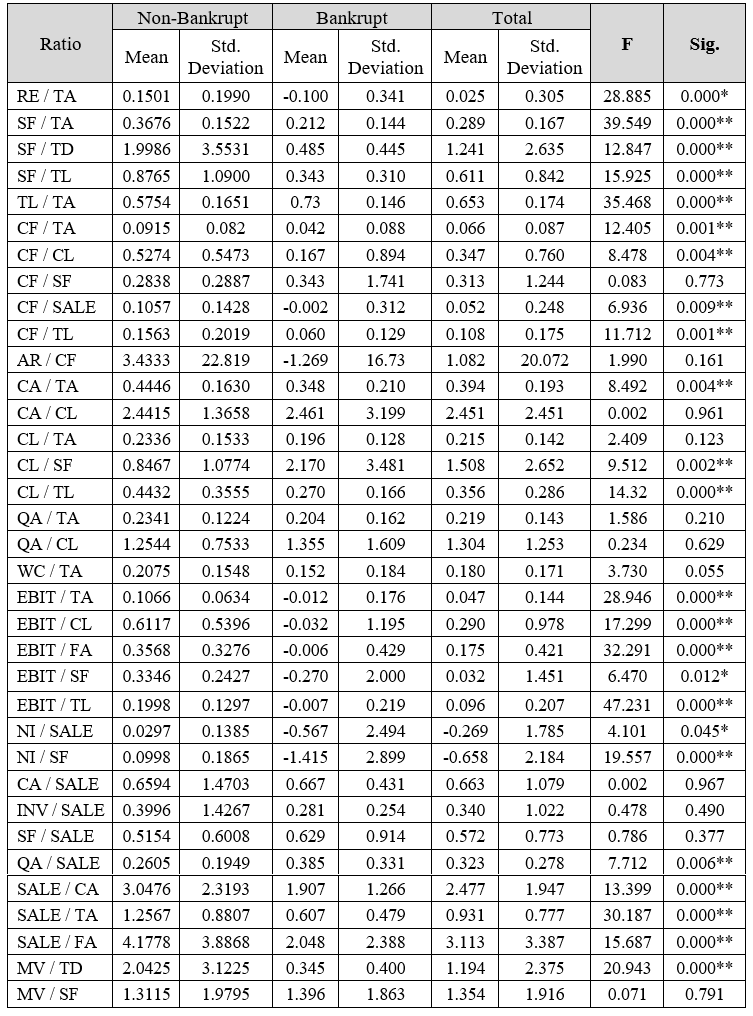

Descriptive Analysis The descriptive statistics are derived by examining financial ratios one year before bankruptcy to find any differences between bankrupt and non-bankrupt corporations. The summary of the descriptive analysis statistics is shown in the table below (Figure 3).

Discriminant Analysis

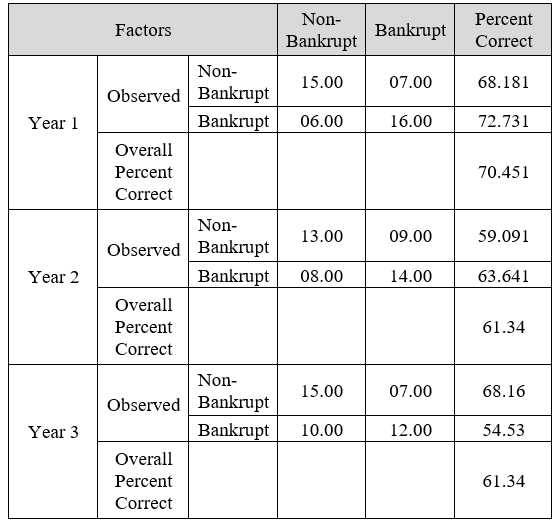

In this research, a discriminant analysis was developed using a gradual selection method. According to their ability to discriminate, each ratio is added one at a time into the discriminant function using the stepwise approach.

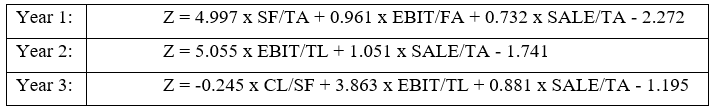

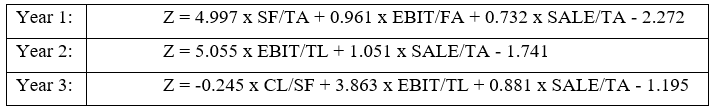

Rational of Discriminate Analysis: The discriminant analysis is a statistical method often used by researchers to classify observations into two or more groups or categories. The discriminant analysis is also used to investigate how variables contribute to group separation, and to what degree. By performing discriminant analysis, researchers are able to address classification problems in which two or more groups, clusters, or populations are known up front, and one or more new observations are placed into one of the known classifications based on measured characteristics. The models for predicting bankruptcy are shown below.

The threshold for use in the functions mentioned above is 0. According to the transition point, businesses with Z scores more than 0 are anticipated to be solvent, whilst companies with Z scores less than 0 are predicted to be insolvent. The total accuracy rate is used to assess the performance of the model. Overall precision is calculated built on the complete numeral of correctly classified items.

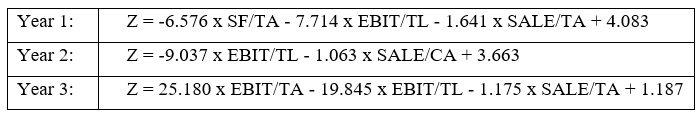

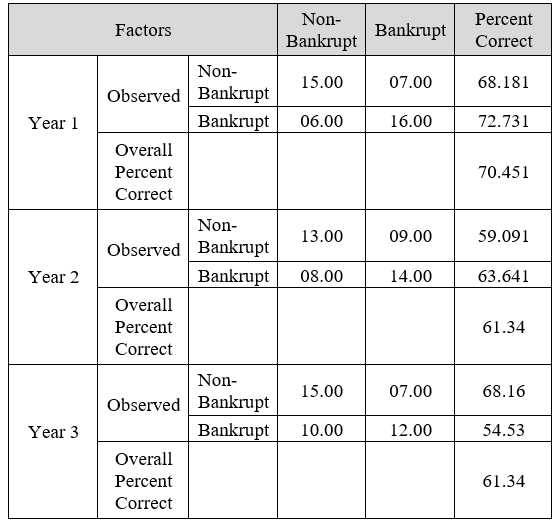

The results of the holding sample's multiple discriminant analysis are shown in the table above. One year previous to the bankruptcy, the rates of accuracy were 70.451 percent; in the two and three years that followed before the bankruptcy, they were 61.343 percent.

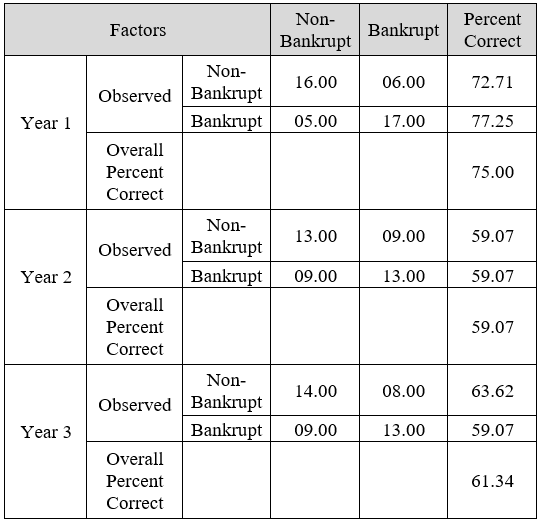

Logistic Regression Analysis Figure 6 : Bankruptcy with Logistics Regression

The logistic transformation is enumerated as P = 1/ (1+e-z) and may be used to convert the model-derived Z score into a probability. The threshold is set at 0.5. It signifies that the firm would be expected to go bankrupt if the estimated likelihood obtained above is more than 0.5.

Figure 7 : Logistic Regression Classification Analysis Results

The table above displays the findings from the holding sample's logistic regression analysis. According to the results, the precision rate decreases from 75% within a year previous to bankruptcy to 59.70% two years before. The accuracy percentage significantly rises to 61.34% during the last year preceding bankruptcy.

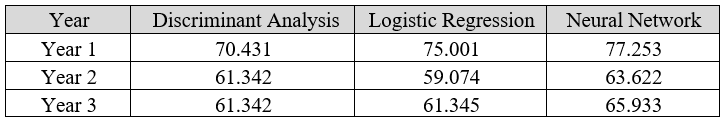

Neural Network Analysis The data set of 72 bankrupts and 72 non-bankrupt enterprises was divided among testing, training, and residual samples for the neural network bankruptcy prediction model. The data sets needed to train the neural network make up the training sample. The training sample comprised 40 non-bankrupt and 40 bankrupt companies to create a model to prevent overtraining, a separate set of data records known as the testing sample is employed to track training errors. Ten enterprises were not bankrupt, and ten were included in the test sample. The holding sample is an additional autonomous data set used to evaluate the completed neural network. The residual 22 bankrupt and 22 non-bankrupt corporations were included in the holding sample. The outcomes of the neural network analysis performed on the holding sample are shown in the table. It is evident that the model's accurateness falls from 77.27 percent within a year before bankruptcy to 63.64 percent two years preceding to bankruptcy before increasing to 65.91 percent in the third year before bankruptcy.

Assessment of Results The outcomes of the three distinct research approaches are compared in the section below.

Figure 8 : Comparative Analysis of Bankruptcy Results

This comparative analysis of classification results is presented in the above table. The findings show that over the period of three years preceding to the bankruptcy, the neural network had the most significant overall categorisation efficiency. Moreover, the results from logistic regression and multiple discriminant analysis are similar.

|

|

In a country where savings are in short supply, the priority was always to prevent productive capital from going to waste in unviable projects. Around high-profile resolutions of defaulted steel-plant loans raised creditors’ hopes, but rampant gaming of the legal process by vested interests is dashing them. That’s where India has been a disappointment. In only 7% of instances, debtors trigger bankruptcies. And the recovery rate for creditors in such cases that ultimately do get resolved is just 18%. Lenders are far more comfortable when they themselves drag firms to the insolvency tribunal. Although still low by global standards, the recovery rate in resolutions initiated by financial creditors is almost twice at high at 35%, according to India Ratings & Research, a unit of Fitch Group. Two years ago, this figure was 46%. This study employs multiple discriminant analyses, logistic regression, and neural networks to build and assess the efficacy of bankruptcy prediction models for Indian-listed companies. The data set contains 72 matched pairs of failed and successful businesses. The insolvent businesses collapsed between 2013 and 2018. For the first, second, and third years previous to the bankruptcy, neural networks had accuracy rates of 77.27 percent, 63.64 percent, and 65.91 percent, logistic regression had accuracy rates of 75.01 percent, 59.09 percent, and 61.36 percent, and multiple discriminant analysis had accuracy rates of 70.45 percent, 61.36 percent, and 61.36 percent. According to the findings, neural networks had the most remarkable prediction correctness for all three years before the bankruptcy, associated with multiple discriminant analysis and logistic regression. The neural network modelling should thus be given professional attention owing to its comparative advantage to be employed as effectively as feasible in the bankruptcy prediction of Indian enterprises. Future research may further enhance this study by including non-financial characteristics since prior studies have shown that these variables considerably increase the forecast accuracy of bankruptcy models. Further research may be done on tiny private Indian firms since this study covers listed Indian companies.

|

|

|

Figure 1 : Discriminant Score Analysis |

Figure 2 : Logistics Function Method |

Figure 3 : Descriptive Analysis of Ratios |

Figure 4 : Bankruptcy with discriminant Analysis |

Figure 5 : Multiple Discriminant Classification Analysis Results |

Prof. Prajakta Khule (2023), THE BANKRUPTCY TREND OF INDIAN COMPANIES: UNDERSTANDING THE SIGNIFICANCE OF RISK ASSESSMENT MODELS. Samvakti Journal of Research in Business Management, 4(2) 1 - 15.