+91-9958 726825

An analysis of Artificial Intelligence and its role in the cryptocurrency

|

Crypto currencies are a fascinating phenomenon around the globe. Rapidly increasing digital currencies continue to be a highly lucrative financial instrument, either for short-term profits on crypto currency exchanges or long-term benefits via asset investments. Another subject that is now receiving a lot of attention is artificial intelligence, popularly known as AI. This is due to the widespread and beneficial impacts that AI has had on a variety of different industries. Crypto currency is one of those Industries which got benefited from Artificial Intelligence in various forms. This paper studies various Artificial tools used in Crypto currency in order to enhance its performance and to help Investors. For this various research papers, blogs, websites, and other secondary sources are analyzed. The finding shows that Market analysis, Sentiment analysis, Crypto trading Bots and so are very important tools that help investors to predict prices and enhance returns. The Branches of Artificial Intelligence works miracle in Crypto Industry. |

|

Cryptocurrency is a field that has flourished in the last decade but is still considered revolutionary. Cryptocurrencies, also known as crypto assets, are a type of digital asset created with the intent of functioning as a tool of trade similar to fiat (Tredinnick, 2019)[15]. Since cryptocurrencies are decentralized, central banks are no longer required to oversee the monetary supply. When compared to other, more stable financial assets, the cryptocurrency price has an extensive range of variation. At the tail end of 2008, the world was introduced to Bitcoin. Money that is decentralized and strongly dependent on the field use cryptography for transactional hashing and signing. These deals are recorded on a public blockchain ledger that can be updated and checked by any networked computer (Sabry et al., 2020)[13]. The past decade's tremendous technical advancements and revolutions include cryptocurrency merely as a small element. Artificial intelligence (AI) is another big topic nowadays because of its far-reaching, positive effects on many fields. Artificial intelligence (AI) is "the science and engineering of constructing intelligent machines, especially intelligent computer programs," as defined by Professor John McCarthy in 1956. Cryptocurrency data is highly valuable for Big Data analysis because of the nature of the blockchain system. The decentralized blockchain architecture, for instance, stores all transaction records for all participants, and the data are well-structured and accurate, making it a data-intensive atmosphere and a perfect resource for performing Big Data analytics (Hassani et al., 2018)[7]. This study will focus on the various Artificial Intelligence tools used in Cryptocurrency.

|

|

The following are the objectives that will be attained by this research:

To achieve these objectives, secondary data was gathered from a variety of sources. (Websites, journals, books, and other e-content).

|

|

Hassani et al. (2018) explained how cryptocurrency and Big Data, two important ideas in a digitalized world, interact with each other. Both of these topics are at the cutting edge of technological research. This paper is about how they overlap and looks at all the new applications and developments since 2016. So, to help academics uncover research gaps and plot out future research, they aimed to provide a comprehensive analysis of the interplay between Big Data and cryptocurrencies.[7]

Sabry et al. (2020) discussed the use of AI methods to deal with the problems posed by the cryptocurrency industry's daily deluge of data, which is too large for any single person to process, analyze, and learn from. Recent studies in this field were discussed, and comparisons were made between them regarding methodology and data sets. It also brought to light several research gaps and opportunities for development.[13] Ammer and Aldhyani (2022) described an LSTM algorithm for predicting the prices of four cryptocurrencies (AMP, Ethereum, Electro-Optical System, and XRP). The LSTM model was tested using the mean square error (MSE), root mean square error (RMSE), and normalized root mean square error (NRMSE) statistics. According to the results of these models, the LSTM algorithm outperformed all other methods in predicting the value of cryptocurrencies.[1] Valencia et al. (2019) suggested using ordinary machine learning technologies and publicly available social media data to forecast Bitcoin, Ethereum, Ripple, and Litecoin cryptocurrency market movements. We examine the use of neural networks (NN), support vector machines (SVM), and random forest (RF) with input features from Twitter and market data. The results demonstrated that cryptocurrency markets might be predicted using machine learning and sentiment analysis, with Twitter data alone able to predict specific coins and NN outperforming the other models.[17] Koker and Koutmos et al. (2020) proposed a strategy for active trading based on reinforcement machine learning and applied it to five major cryptocurrencies in circulation. In contrast to a buy-and-hold strategy, they demonstrated how this model produces higher risk-adjusted returns while mitigating downside risk. When actual transaction costs are considered, these conclusions hold true. They found that the model may be useful for real-world portfolio management, but that its performance was sensitive to the data samples used for calibration.[8] Shahbazi and Byun (2022) incorporated unsupervised machine learning and the Hierarchical Risk Parity model into the cryptocurrency infrastructure. The practice of formal accounting relates to the inherent risk of bitcoin, including the likelihood of occurrence and the declaration of economic effect. The unwarranted disclosure of private key information and the high frequency with which they occur are two of the biggest hazards that must be calculated while dealing with bitcoin. Professionals with more experience with cryptocurrency transactions face less of a learning curve and a lower chance of loss. In the context of risk management, the adjusted risk tail produced by the Hierarchical Risk Parity delivers better output. This result demonstrates the suggested model's resistance to imbalanced intervals and the covariance window estimate.[12] Bowala and Singh (2022) underlined the importance of limiting the newly proposed risk metric when selecting cryptocurrency portfolios, which is preferable to the more standard practice of minimizing the portfolio's variance. Risk forecasting for cryptocurrencies using high-frequency (hourly) big data is investigated using a recently suggested data-driven volatility forecasting approach with daily data. Considerable-frequency statistics show cryptocurrency returns have high kurtosis and skewness. By minimizing a data-driven portfolio risk measure, we may derive optimum portfolio weights that take into account the skewness and kurtosis of our cryptocurrency holdings.[3] Choithani et al. (2022) discussed Recent AI research for cryptocurrency and Bitcoin. SVM, ANN, LSTM, GRU, and other AI and ML approaches linked to cryptocurrencies and Bitcoin have been examined. Some research possibilities and ways to improve results are also discussed. Examining how AI has changed our modern world is the primary focus of this study. The allure of AI is explored along with its impact on the workforce and the opportunities it presents.[4] Sebastiao and Godinho (2021) tested the accuracy of machine learning forecasts for Bitcoin, Ethereum, and Litecoin, and found that trading methods based on such forecasts yielded the highest profits (e.g., linear models, random forests, and support vector machines). In order to determine whether the models' predictions hold true even when the market's direction changes between the validation and test periods, they are first tested in a period of bear markets and then validated during a period of unprecedented turmoil. These results provide support to the hypothesis that machine learning may be used to efficiently probe the predictability of cryptocurrencies and create lucrative trading strategies in these markets, despite the existence of unfavorable market circumstances.[14] |

|

Artificial Intelligence

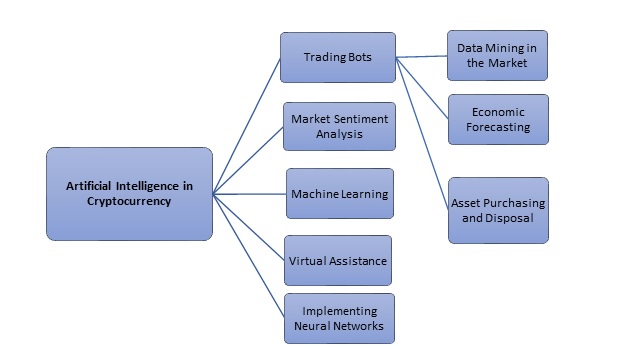

In recent years, as computing power has grown sufficiently accessible for implementation, artificial intelligence has developed as a concept that has shifted from fictitious works into first-application scenarios. John McCarthy provided the first definition of "Artificial Intelligence" in 1956. "The science and engineering of making intelligent machines," he said, defining artificial intelligence. Artificial intelligence and machine learning, a technique that falls under the umbrella of AI, make it possible to construct computers that are designed for the specific goal of doing valuable cognitive activities, sometimes in situations performing such tasks more effectively than humans. Many of the earliest attempts at artificial intelligence took the form of rule-based "expert systems," in which a computer program would simply execute a predetermined set of steps based on the given inputs. Many more complex systems are now possible thanks to recent developments in artificial intelligence. Algorithms can use machine learning to study data and discover patterns that will help them solve problems. Among the many applications for today's more intelligent machines are data analysis, pattern recognition, trend forecasting, task automation, and "brains" for autonomous robotic systems (Scharre et al., 2018)[11] . Making machines behave intelligently is the focus of artificial intelligence research. The intelligence of a system is quantified by how well it can adapt its behavior to different situations while still achieving its objectives. Among the most popular sub-disciplines and approaches utilized to develop intelligent behavior within the subject of AI is machine learning. Classification of Artificial Intelligence The intricacy with which an AI system attempts to mimic human intellect may be used as an additional categorization criterion. Real-world applications and relevant technologies are discussed here. As a result, we may classify AI into operational and theoretical programs. Here are some examples of various forms of AI: Artificial Narrow Intelligence (ANI) Artificial Narrow Intelligence (ANI), sometimes referred to as Narrow AI or Weak AI, is the only AI that is realistically achievable by humans at this time. This approach to artificial intelligence is goal-oriented and can only execute certain jobs (Das 2021)[5] . Siri, Alexa, self-driving vehicles, Alpha-Go, Sophia the Humanoid, and so on are all examples of weak artificial intelligence. Almost all AI-based systems developed so far are examples of Weak AI. Artificial General Intelligence (AGI) AGI, or artificial general intelligence, is sometimes known as deep or strong AI. The assumption that AI can successfully simulate human intellect is purely theoretical at this point. Artificial general intelligence (AGI) may pick up on patterns in its work and become more useful over time as a result. Deep AI can think and comprehend just like a human being. Researchers have made significant progress toward robust AI, but at now it is not yet completely manifested. Machines need to have awareness and varied and wide-ranging cognitive capacities if we are to develop Strong AI (Das 2021)[5] . Even though no instances of Strong AI presently exist, it is widely held that we will soon be able to build robots with human levels of intelligence or better. Artificial Superintelligence (ASI) The level of artificial intelligence known as artificial superintelligence is the point at which the capabilities of computers will transcend those of human beings. At the moment, artificial superintelligence (ASI) is a made-up scenario that only exists in movies and science fiction literature, in which computers have conquered the human race and taken over the globe. The concept of artificial superintelligence is based on the premise that, at some point in the future, computers will be able to comprehend human intelligence in the context of the present. In doing so, they would develop their own set of values and beliefs. Branches of Artificial Intelligence With the assistance of the following procedures and methods, Artificial Intelligence may be put to use to find solutions to issues that occur in the actual world. ![Figure 1: Branches of Artificial Intelligence[18]](/system/files/sjrit/2023.02.30/images/figure_1_branches_artificial_intelligence18.jpg) Figure 1: Branches of Artificial Intelligence[18] Machine Learning is an incredibly challenging subject of AI. It's a branch of study that helps computers and other machines solve real-world issues by gathering, sorting, and analyzing large amounts of data. Since machine learning provides a large amount of data, computers may use it to teach themselves and make decisions on their own. The technique is designed to allow computers to make predictions based on historical data. Algorithms and methods from the field of machine learning help to train a model using the available data to make predictions and fine-tune the model's predictions and adjustments. It's the study of teaching computers to learn new knowledge and transfer it into action automatically. Internet search, voice recognition, and autonomous cars are just some of the innovations made possible by machine learning. We may divide Machine Learning into these three broad classes.

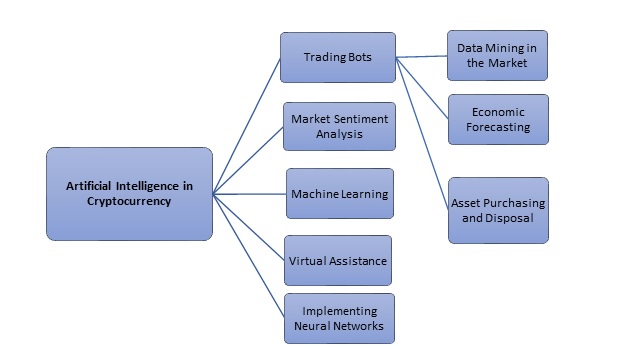

Deep Learning employs Neural Networks on high-dimensional data in order to gather insights and formulate answers. Deep Learning is a subfield of Machine Learning that has the potential to be applied to more complex issues. To put it simply, a neural network is a set of algorithms designed to find basic connections between sets of data in a manner that is analogous to how the human brain functions. As such, a neural network is a collection of neurons, whether they are real or synthetic. perceptron is a kind of artificial neuron, thus we can use this to infer the whole perceptron model of the neural network. A mathematical function (such as an activation function) is a "neuron" in a neural network, and its duty is to collect and categorize input in accordance with some predetermined pattern. Regression analysis and other statistical approaches are used extensively by the network to accomplish its goals. The applications of these models span from forecasting to market research, with applications as diverse as fraud detection, risk analysis, stock-exchange prediction, sales prediction, and many more. Natural Language Processing When humans attempt to connect with a computer system, it might be similar to communicating with someone who doesn't speak your language. Words provide a significant challenge for a computer since they can only grasp binary numbers. As a solution to this issue, the field of Natural Language Processing in computing has developed. To put it simply, this refers to the conduct of training computers and other automated systems to understand common social cues and behaviors. In this method, a computer takes a human voice from an encounter and converts it to text format, making it more legible and intelligible for humans. The computer then breaks down the sentences into pieces that it can use to understand what people are trying to say. Robotics This exciting branch of AI is devoted to the study, development, and production of robotic machinery. Combining technical and scientific principles, robotics is the study of robot design, construction, and use. To ease the burden of hard work, robots are often used. Computer system administration, data translation, and vehicle manufacturing are all examples of such tasks. For the launch of heavy equipment into orbit, NASA uses it. Robots may also be seen as intelligent agents that operate in the actual environment to accomplish goals. Unbelievable progress has been made in this field of AI. Sophia, the humanoid robot, presents a classic case of artificial intelligence in the realm of robotics. Expert Systems Artificially intelligent (AI) systems, often known as "expert systems," analyze and simulate human decision-making processes. Expert systems, as opposed to conventional programming, employ logical notations to find solutions to complicated problems. The healthcare sector makes extensive use of it to manage hospitals and detect viral illnesses. It is also put to use in the financial business for analyzing loans and investments. Fuzzy Logic This subfield of artificial intelligence employs a method to adapt and represent data that is ambiguous, based on an assessment of the probability that the hypothesis is right. Fuzzy logic allows for more leeway in thinking when faced with ambiguities. Applying basic reasoning is all that's necessary to figure out whether a theory has any kernel of truth to it, even if the notion itself may seem a little convoluted. As an example, in accordance with conventional logic, a proposition is considered TRUE if it has a value of 1.0 and FALSE otherwise. However, there are times when an idea is just partly correct. Like humans, computers may be made to struggle so that they can learn to solve problems. Fuzzy logic is used in automatic transmissions and medical decision-making. Implementing Neural Networks- To better anticipate how the crypto market will evolve, neural networks are used. Currency movements are tracked, compared, and forecasted by the system itself. Integration of both technical and fundamental analysis into the system stands to benefit from this. For new crypto traders who haven't had the chance to learn everything, this may be a huge time saver. Though they can't predict the future perfectly, prognostic systems can handle the bulk of technical analysis of the market with remarkable precision. Market Sentiment Analysis- Processing data in vast quantities is required to ascertain the market sentiment of cryptocurrencies. These may be anything from an article to a blog post to a forum thread to the comments section below. Senno, a blockchain and AI-powered platform does the analysis automatically and returns the answer rapidly. Aspects of machine learning are also included in the system's operations. Finding the Right Broker- The dearth of readily available funds is one source of friction in the Crypto industry. Digital currencies are not preferable as commercial payments due to their high volatility in exchange rates. High fees from exchanges and banks are typically used to offset the disparity between supply and demand. Machine-learning technology-based solutions like Trade Connect are being utilized to address the issue. With its side-matching procedure, it aids clients in finding the best broker and bank for them, allowing them to deal with them directly at a low cost. Utilization of a Virtual Assistant- Some businesses are actively working on AI systems for service providing in the Crypto industry. The Money Token team, for instance, developed the AI assistant Amanda to serve as a resource for the cryptocurrency industry. From the time of application to the final repayment of the loan, the virtual assistant will be able to issue loans secured by Crypto collateral and handle all related matters. Using Crypto Bot Securely- Be cautious about whom you provide access to your exchange API keys. Only reliable services with a solid track record get such praise. Remember that the API key is a kind of authorization to access your account and conduct transactions such as withdrawals and trades. There is no indication of fraud just because a bot needs the API to function. Before committing to any one platform, it's important to do some research. Investigate the existing security measures. Two-factor authentication should always be used to restrict account access. Introducing Robotic Trading- Typically, robots are utilized to conduct automated trading on stock exchanges. There are a number of benefits associated with crypto bots' speculative actions, which have led to their widespread use. There's no need for the trader to keep tabs on the market for virtual currency or to carefully time when to enter and exit trades. By automating the trading of digital assets, crypto robots remove human emotion from the process. Most inexperienced cryptocurrency traders lose money because they are unable to control their emotions and thoughts and because they break the rules of their own trading plan.  Figure 2: Artificial Intelligence in Cryptocurrency

The above figure 2 shows the role of artificial intelligence in cryptocurrency and the importance of Trading bots. Trading bots have their benefits, such as automating deals, but they can have their drawbacks if the trade doesn't go as planned. This is due to the fact that once orders have been provided, they are final and cannot be altered.

Artificial intelligence's capacity to mimic human intelligence has led to its widespread use in high-frequency trading strategies among investors and analysts. Faster traders tend to do better financially than their slower counterparts. High-frequency trading is a kind of algorithmic trading in which several orders are executed by a computer in a fraction of a second, and it is used by many investments and hedge firms. |

|

Cryptocurrencies are fascinating phenomena in the current world. The cryptocurrency market is expected to rise 7.1% from USD 1.6 billion in 2021 to USD 2.2 billion in 2026[16]. Access or distributed ledger technology and venture capital funding drive cryptocurrency market growth. Challenges specific to emerging markets have been met head-on thanks to Bitcoin's widespread adoption. The field of artificial intelligence (AI) is also expanding rapidly, with far-reaching implications for individuals and society at large. While there is no doubt that Blockchain and AI will continue to see widespread adoption and development, some have expressed scepticism about the technologies' actual usefulness. Artificial intelligence can rapidly evaluate massive data sets and forecast future market patterns. In the unpredictable and ever-evolving realm of cryptocurrency trading, this can be especially helpful. Traders may make consistent profits from price swings that occur often throughout the day. The burgeoning crypto business requires vast data analysis to uncover patterns that AI and learning robots can subsequently exploit. Crypto trading bots make it simple to automate the process of analysing market data. They can do things like purchase and sell cryptocurrencies, as well as gather and analyse market data and assess potential market risk. The use of AI is growing in the crypto industry. The use of artificial intelligence (AI) in the cryptocurrency industry includes enhancing mining hardware's efficiency, reducing mining's environmental impact, and studying market data to identify the most profitable coins to mine. Automated dealing in the market for digital currencies like Bitcoin is another area where AI is being used to help dealers keep up with the rapid pace of technical and societal change. More importantly for blockchain applications, AI algorithms are being used to evaluate, comprehend, categorize, and forecast based on these data. Popularity is also growing for digital assets built on artificial intelligence.

|

|

|

![Figure 1: Branches of Artificial Intelligence[18] Figure 1: Branches of Artificial Intelligence[18]](https://www.samvaktijournals.com/system/files/sjrit/2023.02.30/images/figure_1_branches_artificial_intelligence18.jpg) Figure 1: Branches of Artificial Intelligence[18] |

Figure 2: Artificial Intelligence in Cryptocurrency |

Shikha Singh (2023), An analysis of Artificial Intelligence and its role in the cryptocurrency. Samvakti Journal of Research in Information Technology, 4(1) 1 - 16. DoI : 10.46402/2023.02.30